|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

cat insurance rates explained and comparedWhat shapes the priceCat insurance rates vary with age, breed risk, location, and the coverage choices you make. A young indoor cat in a low-cost region usually sees lower premiums than a senior with chronic conditions. Deductible size, reimbursement level, and annual limits also tilt the monthly cost up or down. Comparing popular optionsAmong well-known insurers, differences appear less in headline price and more in what that price buys. Some brands market lean, budget plans suited to emergencies, while others focus on broader illness coverage and fast claims handling. Pay attention to waiting periods, dental illness treatment, and whether exam fees are covered.

Tip: gather quotes on the same cat, same deductible, and same reimbursement. Then compare total five-year cost, not just the first month. https://www.usaa.com/insurance/additional/pet

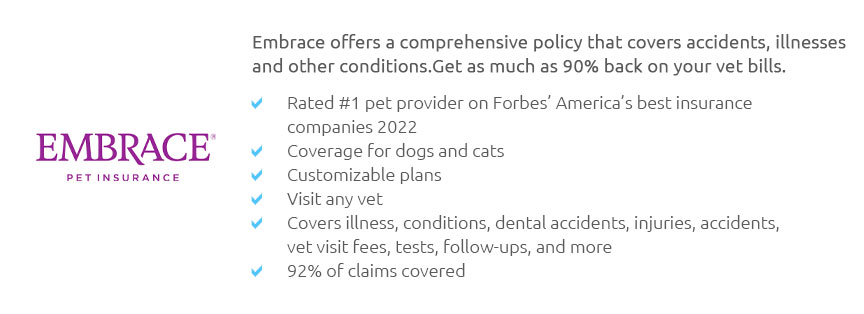

Pet insurance to help protect your fur babies. Save up to 25% on coverage for dogs and cats. See note 1 Get a quote online or call Embrace at 888-967-6807. https://www.embracepetinsurance.com/research/pet-insurance-cost

On average, Embrace offers affordable monthly premiums, typically ranging from approximately $8 to $38 for most cats and $18 to $72 for most dogs. These ... https://www.petsbest.com/pet-insurance-cost

Premiums for pet health insurance are based primarily on your dog or cat's age, breed, location, and your plan's annual limit, deductible, and reimbursement ...

|